Banks have started increasing the interest rates based on the past payment history of the borrowers. For people who have good payment history and credit scores, banks are offering a discount of 0.25% to 0.50% in interest rates. A credit score plays an important role in every bank user’s profile. Here is all you need to know about it.

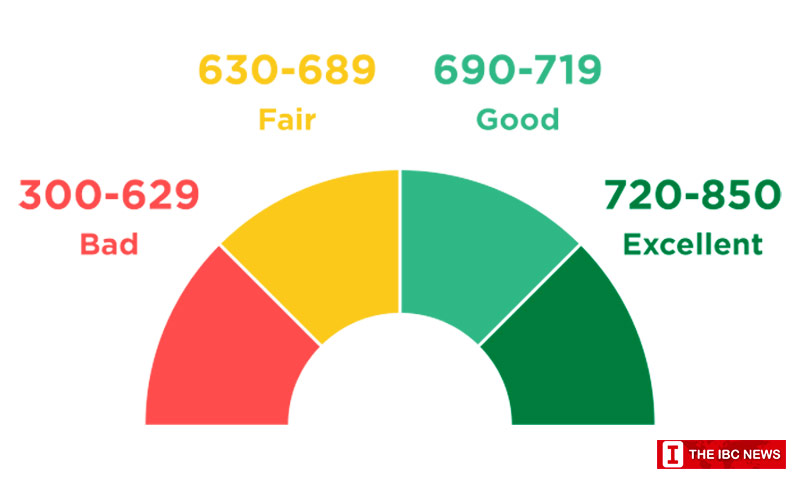

Generally, a credit score is calculated from 300 to 900 points. A score of more than 750 points is considered a good credit score. It means that the user is financially stable, paying loans and credit card bills on time. Banks offer loans to people with a good credit score quite easily. It becomes a bit difficult for people with a low credit score.

A credit score is considered ‘poor’ if it is between 300-550 points. People with such a score should be highly cautious. They need to find out ways to improve their credit score regularly by paying credit card bills and loans on time. A thorough financial discipline is needed to improve the credit score.

To increase the credit score, one needs to find out the reasons behind its downfall. The credit report can be obtained from credit bureaus and online banking aggregators. In most cases, failure of credit card bill payments and loan payments will be the major reason for the decrease in credit score. High loan utilization ratio, unsecured loans, and giving false information to banks are some of the other reasons which can lead to a decrease in the credit score.

Having a low credit score will affect a user’s financial profile. Getting new loans will become difficult. Even if the loan is given, the interest rate will be high. To improve the credit score, one needs to pay the instalments of existing loans regularly. They should also ensure that the loan utilization limit ratio of credit cards is less than 30 per cent. They should also avoid applying for loans and credit cards when there is no need. If the credit report has mistakes, one should immediately contact the bank or Non-Banking Financial Institutions (NBFCs).